IFRS 9: Financial instruments

An intensive two day course giving you a deep dive into IFRS 9

Covering classification and measurement of financial instruments, expected credit loss (ECL) impairment, hedge accounting and related IFRS 7 disclosures, this course seeks to tackle one of the most complex areas of financial reporting. Through clear explanations and real-world examples, participants gain the knowledge and confidence to approach IFRS 9, ensuring both recognition and disclosure requirements are met with clarity and accuracy.

£1,950*

*excl VAT for UK courses

Learning objectives

- Analyse financial instruments to differentiate between liabilities, equity or a combination of both

- Apply the principles for classification, initial recognition and subsequent measurement of financial assets and financial liabilities in IFRS 9

- Evaluate the principles of fair value measurement in IFRS 13

- Determine the accounting for derivatives and embedded derivatives

- Compute the effective interest rate and apply the effective interest method for measurement of financial instruments at amortised cost

- Apply the derecognition principles to financial assets and financial liabilities

- Apply the expected credit loss model and calculate impairment losses for financial assets

- Obtain an overview of hedge accounting and analyse the requirements in IFRS 9

- Comply with the extensive disclosure requirements of IFRS 7.

What's included?

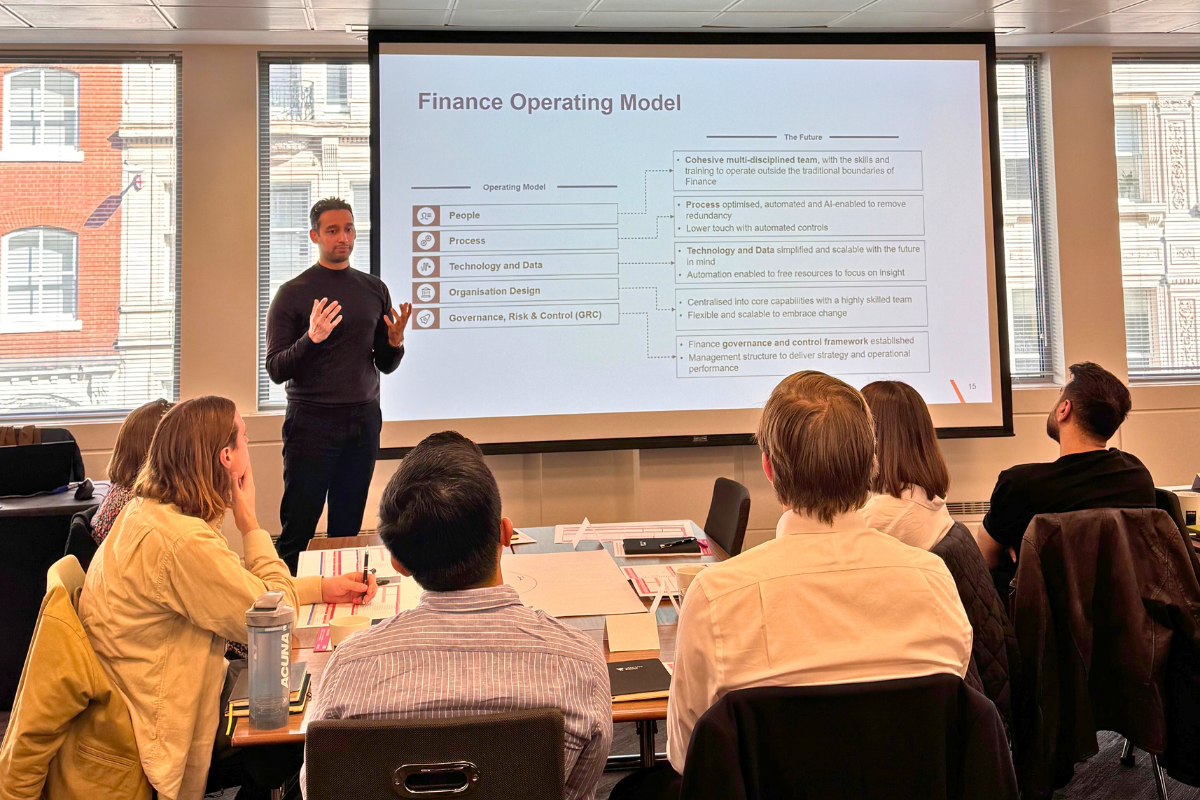

This course is delivered in an expert-led, interactive format designed to bring clarity to one of the most technical areas of IFRS:

- Group live instruction by IFRS specialists with deep experience in IFRS 9 and it's financial instruments

- Real-world case studies and examples illustrating the principles of IFRS 9 in practice

- Interactive group discussions and Q&A to explore challenges and industry-specific applications.

- In line with VantagePoint’s sustainability commitment, course materials are provided in digital format. Printed handouts will be limited to in-class exercises only and fully electronic course materials (including case studies, illustrations and examples) will be provided for you to keep.

- NASBA approved CPD/CPE credits.

Who should attend?

- Financial and management accountants in corporate and financial institutions

- Staff in treasury, operations, risk management, IT or compliance departments

- Internal auditors of entities reporting under IFRS

- External auditors with clients facing the complexities and challenges in adopting and implementing IFRS 9

- Staff and management of central banks, deposit insurance entities and other agencies with regulatory responsibility in the financial services sector

- Financial analysts seeking to improve their understanding of the accounting and disclosures related to financial instruments and the changes impending with IFRS 9

- Professors and other instructors with educational facilities

- First-time adopters of IFRS, seeking to analyse the implications of adopting IFRS 9 initially for their financial instruments accounting.

What can I expect?

- A full, interactive and challenging experience

- Networking opportunities with like-minded professionals on similar journeys

- Well-equipped classrooms - all our courses take place in state-of-the-art hotels or event spaces with excellent facilities

- Your very own VantagePoint welcome pack containing a selection of goodies to get you on your way.

There is no advanced preparation or prerequisites required for this course.

IFRS 9: in detail

See in-depth information about the course

This course provides an in-depth analysis of principles in IFRS 9. The course has numerous examples and illustrations to explain the business model and cash flow characteristics test for classification of financial assets, amortised cost and fair value measurement of financial assets and financial liabilities, de-recognition of financial assets (retained servicing, continuing involvement etc.), measurement of expected credit losses and the accounting and impact of different types of hedges on financial statements. In addition, it covers the financial instruments disclosures in IFRS 7 and principles in relation to fair value measurement in IFRS 13.

The course is designed to help preparers and users of financial statements to evaluate the impact of IFRS 9 on the financial statements.

Introduction

- Introduction to IFRS 9

- Recap of IAS 32 financial instruments: presentation – financial liability versus equity instruments, compound financial instruments and offsetting

Classification of financial assets and financial liabilities

- IFRS 9 classification: amortised cost, fair value through other comprehensive income and fair value through profit or loss

- Business Models criteria

- Solely Payments of Principal and Interest (SPPI)

- Fair value option

Measurement of financial assets and financial liabilities

- Initial recognition, including treatment of transaction costs

- Subsequent measurement

- Amortised cost

- Fair value measurement (IFRS 13)

- Reclassification of financial assets

- Fair value movements due to own credit risk in financial liabilities at fair value through profit or loss

- Accounting for derivatives and embedded derivatives

Amortised cost financial assets

- Computing the effective interest rate

- Applying the effective interest method under various scenarios

- Plain vanilla bonds

- Variable rate instruments

- Financial assets that are prepayable

- Loan commitments

- Fee income and loan origination costs

- Financial guarantees

- Repossessed assets

Derecognition principles

- Derecognition of financial assets

- Determining whether a transfer has occurred

- Transfer/retention of substantially all risks and rewards

- Retaining “control” and measurement of continuing involvement

- Derecognition of financial liabilities

Impairment of financial assets

- Introduction to IFRS 9 expected credit loss model – background, scope and impact of the model

- Application of IFRS 9 expected credit loss model

- 12-month and lifetime expected credit losses

- Staging of financial assets

- Determination of significant increases in credit risk

- Measurement of expected credit losses

- Modified financial assets

- Simplification and practical expedients

- Purchase/origination of credit-impaired financial assets

- Loan commitments and financial guarantee contracts

Hedge accounting

- Overview of hedging and accounting for three types of hedges – fair value, cash flow and net investment hedge

- Impact of hedge accounting for interest rate and foreign exchange risk

- IFRS 9 hedge accounting model

- Hedged items

- Hedging instruments

- Qualifying criteria

- Groups and net positions

- Hedge documentation

- Hedge effectiveness requirements

- Rebalancing

- Discontinuation

IFRS 7 financial instruments disclosures

Updates

- Macro-hedging

This course is delivered in an engaging, workshop-style format combining technical instruction with real-world application:

- Group live instruction with sessions focused on key IFRS 9 and IFRS 7 requirements tailored to practical business contexts

- Worked examples and case studies covering classification, measurement, impairment and hedge accounting

- Interactive discussions and Q&A to explore complex issues, implementation challenges and best practices

- Use of illustrative disclosures, financial statements and tools to bridge theory and practice

- In line with VantagePoint’s sustainability commitment, course materials are provided in digital format. Printed handouts will be limited to in-class exercises only.

This course provides 16 hours of CPE/CPD credits.

VantagePoint is currently in the process of registering with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

_032.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_032.jpg)

_069.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_069.jpg)

_027.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_027.jpg)

_078.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_078.jpg)

_085.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_085.jpg)

_030.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_030.jpg)

_034.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_034.jpg)

_041.jpg?width=1200&length=1200&name=VantagePointTrainingDay21.03.24(%C2%A9ElyseMarks)_041.jpg)

Bring this course in-house

Do you need to upskill your team? We specialise in the design and delivery of bespoke events for finance and sustainability teams.

Contact us to discuss your requirements - we'd love to hear how we can help.

Bespoke options for your team

Our course schedule can change based on demand from our clients. If there's a new topic that you'd like to see please let us know.

Stay updated

To stay up to date with news on our latest courses, topics, webinars and free in person events sign up to our newsletter using the button below.

Bring this course in-house

Bespoke options for your team

Stay updated

VantagePoint Training attendee

HSS Hire - attendee

Chinonso Nwagbara

Five day course - attendee

VantagePoint Training attendee

CIIPA - attendee

"Very professional and efficient service - kept to allocated timings and audio/visual was very smooth."

VantagePoint Training attendee

EUMETSAT - attendee

Trusted by