by Matt Gilli

The honest guide to finance transformation | VantagePoint

Finance transformation has gained traction over recent years: VantagePoint's complete guide helps you discover if it's right for your business.

Read moreOver the past few years, the term ‘finance transformation’ has gained traction in the finance sector. If you play any role in a finance team, you’ll at least have heard of this approach, if not attempted to initiate it in your own organisation.

True finance transformation comes from a combination of process, system and cultural change.

The problem is that where ‘finance transformation’ once had a clear, targeted meaning, the waters have now become muddied. This means that in place of the expected transparency and optimism around updating the way you work, there is often now a sense of scepticism and anxiety.

We know this because we speak to CFOs every day who are doubtful of the effectiveness of finance transformation. Either they’ve tried it before, with disappointing results from the technologies or provider they worked with, or they’ve heard of negative experiences from peers and want to avoid making the same mistakes.

True finance transformation comes from a combination of process, system and cultural change. It doesn’t make good financial sense to spend thousands on a technology overhaul if your finance team cannot then use that technology. Likewise, a change in your business doesn’t count as finance transformation if your team still feels overworked, stressed and pressured at month end.

A successful finance transformation positively impacts everyone across your business on a day-to-day basis. It lowers your costs and allows you to reduce headcount, doing even more with fewer people. Not only this, but it gives you greater insights into your business, offering easy-to-use data and reporting, ultimately lowering risk to make you more compliant.

With competitors raising their game, now is the time to act. On this page, we’re going to answer the questions we regularly hear from businesses, helping you decide if finance transformation could benefit your business after all.

Chapter 1

An introduction to finance transformation

In simple terms, finance transformation is the combination of process, system and cultural change across a business, implemented through new technologies, training and analysis. As a practice, it is suitable for finance teams seeking to streamline, simplify and optimise their systems through a shift in their approach. Commercial Director at VantagePoint, Liam O’Brien explains that:

When most people define finance transformation, they think about technology. There's a popular move towards providers claiming that it’s a combination of new technology and a process overhaul, but what isn’t always clear is the kind of services offered to train teams and help them engage with these changes.

Transformation doesn’t come from technology alone

Many vendors claim to offer finance transformation, but what this often means is that they’ll sell you the technologies to update your internal finance systems, without the operations training that your team requires. Without enabling strategic change, this means that businesses might have spent a lot of their budget on the latest technology, without actually being provided with a complete roadmap to transform their systems. They don’t feel the benefit of their investment. Matt Benaron, Director at VantagePoint, explains his experience:

We see lots of clients with previous finance transformation projects who are unhappy because they've spent lots of money on something and they don't feel like they saw the return on investment that they should have.

In this video, we explain how and why to review your finance processes:

The long-term expense

Additionally, it’s easy to be persuaded by ‘quick-win solutions’ such as interim technology, which may be more affordable in the short term, but which you will outgrow quickly. CFOs know they need to make changes, but it can feel overwhelming to initiate an “overhaul” when a simpler, more affordable solution might keep problems at bay for a while. These options regularly don’t scale with your company though, and merely tick a box to help you feel like you’re taking steps forward.

If you feel like this has been your approach in the past, you aren’t alone: when asked in a recent VantagePoint survey, 45% of participants said implementing new finance solutions and processes would be where most of their focus is spent over the next year. David Sillett, Director at VantagePoint, explains that short-term solutions are something many CFOs have tried before speaking to him:

I think that, over the long term, what many businesses don't realise is that they're going to end up spending more money with short-term solutions. Proper finance transformation is an initial investment, but over five years the way they're doing it currently works out far more expensive. Sadly,a lot of finance teams work in such a ‘hand to mouth’ waythat they often don't have time to look past this year.

Feeling overwhelmed by your options

Having spoken to many CFOs, we see patterns in the things they tell us: for many, they recognise that their business needs to make a considerable investment but are reluctant to initiate it. Many businesses still rely on convoluted, outdated processes which are potentially damaging to their business – but the alternatives seem too immense to get a grip of. In a recent VantagePoint survey, only 21% of organisations want to move away from Excel completely, with the majority still seeing it play some part, and 14% wanting to use Excel exclusively.

Being able to predict future outcomes and planning for growth are two activities that often fall by the wayside because completing the current workload feels too all-consuming. This is a regular pattern for many clients that the VantagePoint team speaks to: many CFOs don't know where they’ll be in the next three to five years, and instead they would like to be able to picture that. To get there, many need help accessing the appropriate technologies that are available and navigating in the right direction for their business.

How financial transformation looks practically

Some practical examples of the changes finance teams can expect from finance transformation include:

- Your finance processes and systems are standardised to avoid error and increase efficiency.

- Your month-end reporting becomes automated, instead of a week or more spent creating a board pack.

- Further automation across business functions will ensure cost-saving opportunities across your department.

- Collaboration across the team becomes far easier: you're equipped with a centralised finance data hub which enables collaboration.

- Opportunities to operate as a remote team – this means potentially lower wages and more savvy payroll planning.

Understandably, CFOs need a quick, reliable and thorough service. Their team requires training, onboarding, consultation and a ‘people element’ which is often missing from finance transformation offers – it’s a change in attitude as well as a physical process. You can find out more about the benefits your business will experience following finance transformation in Chapter 2.

Summary:

Selecting an ERP system is an extremely complex process, and with large software contracts on offer, salespeople can be falling over themselves to reel you in any way they can. VantagePoint is a finance consultancy with decades of experience implementing ERP systems for businesses.

Unlike many consultancies, we help at every stage of the decision-making and implementation process, long before a decision has been made with a vendor. We offer impartial advice based on our experience with businesses like yours, to ensure you are set on the path to ERP success. For more information on our services and how we can help you select the right ERP system, do this CTA.

Chapter 2

Who will benefit most from changing their financial processes?

It’s impossible to give a closed answer to this question: there is no specific industry, size or budget that should make one company think about finance transformation more than another. It’s common for SMEs to think they’re too small for finance transformation and that it’s a domain for larger enterprises. Rather, it comes down to factors such as:

- The current day-to-day running of your business

- How you regulate workload across the month

- The accuracy and efficiency of your reporting tools

- IFRS 17 and other industry-specific compliance measures

- How easily your team shares data and collaborates together

- The physical and mental wellbeing of you and your staff.

The misconception about budget and who finance transformation “is right for” is a question Matt Benaron, Director at VantagePoint, is asked time and time again:

Finance transformation is often talked about in such broad terms – it’s used by vendors when speaking about their technology – that people don’t really know what it means. Vendors will often describe technology projects as ‘finance transformation projects’. But implementing one budgeting planning system isn’t finance transformation. Plus, for many smaller companies, they think it’s too big or too expensive for them.

If your team is willing to learn new processes, you have enough cash flow to invest in the right tools (only those that are necessary to your business), and you want to see long-term benefits to the way your team operates, then you’re ready to start talking about finance transformation.

Better data, analysis and reporting

Having a better grasp of data – and the time and tools to analyse what it actually shows – is a major incentive for businesses we speak to. Sometimes companies already have accurate data, but lack the ability to analyse and learn from it, in other cases, the data itself isn’t trustworthy and so there’s a problem from the start.

Turning data into insights was the main data challenge facing organisations, according to a recent VantagePoint survey, with 45% of participants citing it. David Sillett, Director at VantagePoint, says this is something that comes up a lot in his conversations with customers:

Clarity of reporting is something that CFOs are getting pushed towards more and more. They're dealing with demanding directors who want to know things like: are we going to have enough cash? Where can we make cuts? Where can we save costs? Where do we need to spend? What's the advantage of investing more into sales at a time like this?

The expectations and pressures on CFOs are higher than ever; it is no longer an option to lack these forecasting abilities, so they need quick, easy, automated ways to provide directors with the figures they need – and use them for long-term financial planning.

Reconsidering the status quo

It’s a common misconception that month end has to be a particularly stressful time for finance teams because “that’s just how it is.” Team members who feel overrun and overwhelmingly busy believe this to be an unavoidable part of life in a finance team, when, in reality, better alternatives exist. Much of the crush that happens around this time is down to inefficient processes.

Liam O’Brien, Commercial Director at VantagePoint, acknowledges the huge expectations placed on CFOs; their role often seems overwhelming, especially in the wake of Covid-19 when financial implications for businesses are more pressured than ever:

The CFO will be most interested in cost saving, remote efficiency, and the clarity and speed of reporting. In the cost-saving part of automation, CFOs need to know about automated cash-flow planning, scenario planning in a system rather than in Excel, and potentially a process redesign so that they don't have to have as many people in their team. If they're not going to bring everyone back from furlough, how do they adjust to that? They can actually do more with less.

If you’re a CFO, you’ll be seeking to reduce your costs by:

- Running an ‘evaluate and simplify’ advisory engagement

- Implementing standardisation

- Introducing a process change

- Building a group chart of accounts

- Creating a defined target operating model

Yet these might not be a priority – or it may feel too big to make a start on. Sometimes it feels simpler to stick to the same Excel processes you’ve used historically. If this is how you feel, there are others like you: Having no process management (63%) and not enough auditability (54%) were cited as the greatest challenges posed by Excel in a recent VantagePoint survey.

Teams who rely heavily on Excel as a solution are often found in organisations where the finance team is growing far bigger than it needs to be. Now is a good time to review your processes and cost-saving methods as your business looks to a more efficient, less expensive way of surviving into the future.

The wellbeing of your finance team

As a CFO, you’ll naturally be concerned for the wellbeing of those around you. You have a responsibility of care and – while it is acknowledged that the world of finance isn’t without its stresses – minimising unnecessary pressure to ensure happier, more efficient workers should be at the top of every manager’s list.

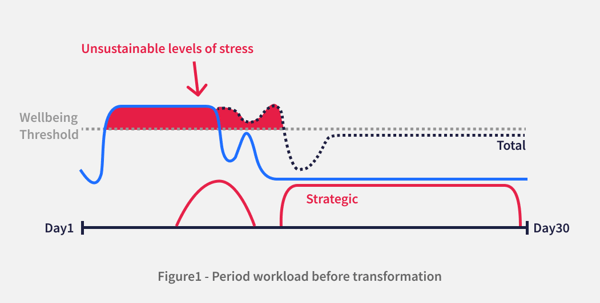

One of the biggest causes of pressure for finance teams is the lack of predictability and regularity of workload. While some parts of the month can be spent on strategic, forward-planning tasks, the majority of the workload covered by most financial professionals is core accounting processes. In his article about the wellbeing benefits of finance transformation, Mark Cracknell, Director at Finance Utopia uses this chart to show how wellbeing is affected at different times of the month for finance workers:

Source: LinkedIn: Mark Cracknell - founder of Finance Utopia

He explains that:

A typical group finance role in a large organisation...has yet to transform and embrace technology as an enabler. Their processes are highly manually intensive... The core workload increases in this period with the close of the underlying accounting systems and the activities associated with this. The workload continues at a high level during consolidation and the potential re-forecasting process... For a significant portion of the period, the finance professional is working above what we term the ‘wellbeing threshold.

If teams are consistently subjected to high levels of stress, this will have far-reaching implications for their own health and the productivity of the business: in short, both will eventually “burn out”. Making the team’s workload more predictable and regular throughout the month is the clear answer to address this endemic issue.

Obstacles in the way of compliance

Another problem faced by many teams, which causes ongoing strain, is that only one or two people in the team can use the technology currently in place. This may be because the software is difficult to use or involves training which only one team member has completed. Teams who rely on a ‘gatekeeper’ to implement internal systems often find bottlenecks occur and delays are common.

Over a third (36%) of participants in a recent VantagePoint survey said compliance and regulatory reporting requirements have been the greatest challenges for them in the past 12 months. With this in mind, try asking yourself how prepared your business feels. If you were asked to provide reports to adhere to industry-specific requirements, how easy would it be for you to produce these? How accurate would they be? Could the vast majority of your team produce them, or only one or two experts on your team?

Chapter 3

Service that goes hand-in-hand with technology

Consultancy is at the heart of great finance transformation. When choosing a good service provider, the priority is to ensure that training on the new processes and technologies being introduced to the business is provided for your staff, turning them into in-house experts.

The goal is for you to be running your own finance department, without the need for much external support: that’s the position VantagePoint helps you reach.

If you work together with a service provider to implement technological improvements, you can expect to see improvements such as:

- A rapid drive in automation

- Prevention of team members being overly reliant on Excel

- The creation of internal experts in whatever technology you bring in

- The ability to get your organisation ready for the M&A war path.

Making changes – and seeing the positive effects fast

Without a training element, many companies are let down by vendors – and this can contribute to a feeling of reluctance to pursue another solution. Understandably, CFOs are often left feeling that the technology just isn't right for them. However, it is essential to keep an open mind, be willing to learn new things and take a solutions driven approach in order to progress with your finance transformation. Some of the positive changes you’ll quickly see at your organisation are explained by VantagePoint Director, David Sillett:

After working alongside consultants, CFOs will be a lot more efficient. They're not going to be stuck in stressful month-end reporting cycles or strenuous manual reporting. They're not going to have their teams saying “I have no time.” Plus, there is going to be more room for things like scenario planning, better cash-flow planning, better budgeting planning and tidying up the basics of what they have.

David speaks to many clients who want a solution that is free of sales and marketing jargon. At VantagePoint, we understand that CFOs are busy people who don’t have time for a lack of transparency; they want to be solutions and systems focused. This is why our process centres around clear communication and end results, rather than an unnecessary/superfluous fixation on the technology that gets you there.

Improving the day-to-day running of your business, and the accuracy with which you can report on your data, is likely to be your driving factor for seeking finance consultation. In a recent VantagePoint survey, less than half of all participants (45%) said they feel well equipped to view, interrogate, understand and have trust in their numbers. With this in mind, arming you with more efficient ways to work – moving away from Excel – is one of our priorities.

The ability to plan for your future

The problems with Excel are no secret within the finance world. It’s a cumbersome, error-prone and slow method by which to share data and create reports. Auditability of spreadsheets is incredibly poor. Often, businesses are also contending with limited user management, no audit trail or a real sense of version control. This puts organisations working in this way at very high risk – and creates uncertainty in their future.

Director at VantagePoint, Matt Benaron, speaks to many CFOs who are searching for long-term solutions, but struggle to find the right one, settling for technologies that prevent them from seeing the bigger picture:

We meet many CFOs who have signed up for a three-year or five-year license fee on software that they shouldn't even be using for more than a year. Realistically they should think about technology in a five-year time span. They’ve bought an interim solution, but they treat it as a permanent one.

60% of participants stated that data breaches and hacks are the greatest concern for organisations in a recent VantagePoint survey. By using a finance-specific technology solution, instead of perpetrating these risky practices – for example, sending an Excel spreadsheet around to different people to fill in their sections – your team would all be logging into a system and accessing the same data in one place.

Another benefit is that budgeting planning consolidation has anomaly detection built into the system, making the data you use accurate and relevant. This is essential for teams who want to start strategising ahead of time, rather than acting reactively to what is happening right now. Liam O’Brien, Commercial Director at VantagePoint, explains how the VantagePoint offer helps businesses look to the future:

With consulting, CFOs will have a good insight into their current space and they will know what their future space needs to be. This is something they don't often have. So, we give them a process and systems roadmap as well. They'll have better insight into what they need to do next. A lot of the time, companies just sign up to another year of technology they're not really happy with, but it'll do for now.

With the right tools in place, finance teams can plan for long-term solutions, and start future proofing their business. Instead of merely surviving, businesses can start to feel the benefits of thriving.

Chapter 4

Moving toward technology that will actually help you

Technology alone doesn’t warrant a ‘transformation’, but it is an important part of the bigger picture. It’s normal for finance teams to feel trepidation and denial around implementing a new system, especially with technological aptitude becoming increasingly important in the expected skillset of CFOs, as FM Magazine explains:

Technology is reducing the need for constant human scanning of historical data. Such processes can be automated, allowing the employee more time to focus on analysis for the future…

...The top three skills that CFOs — mainly from companies with annual revenue of more than $1 billion — listed for helping to develop finance departments were analytical skills, expertise in digital technologies and automation, and core business skills.

Any lack of trust often stems from previous bad experiences where enterprises have been let down. David Sillett, Director at VantagePoint, sees a lot of businesses who are reluctant to try new technologies or practices because of their negative experiences with previous providers:

Often, because the technology that companies have bought will be oversold, it will also be configured in the wrong way. For many vendors, the priority is to implement technology systems really quickly and really cheaply. They don't go into training people; it’s not a people-process technology solution. It's just a technology solution.

At VantagePoint, technology goes hand-in-hand with consulting; if the new systems we introduce to your team aren’t actually used by everyone in practice, then we haven’t achieved our objective.

Common technology fears for CFOs

Common problems many CFOs face when deciding whether to introduce a new technology include:

- Whether doing things the same way as they always have done will continue to work in this digital age, or if it’s going to compound the problem.

- How their team will feel confident to get the most out of their technology and use it properly.

- If the return on investment will be worth it: will their team be able to get enough use out of the technology to justify its cost?

Matt Benaron, Director at VantagePoint, has noticed that a fear of technology can actually paralyse CFOs and their plans for finance transformation:

I spoke to a CFO yesterday who was thinking about changing their systems and processes by bringing in somebody like VantagePoint. They've now decided they’re not doing it for a year. The reason is they went out to the market, were really overwhelmed by the amount of technology there is, and have decided to stop for now.

CFOs seeking finance transformation need to recognise that technology initiatives need to be executed alongside and supported by experienced consultancy providers to see optimal results. If vendors sell you technology alone, you may not use it to its full potential – this is no fault of yours. You are finance experts, not IT and technology experts, and VantagePoint acknowledges this fact during training.

Technology’s place in managing your finance team

Many CFOs acknowledge that embracing technology can help reduce the size of their team – or at least prevent the need to keep expanding it, and with it, the associated costs. Yet many still admit to feeling unready for a shift towards new technology.

The reassuring thing to bear in mind is that technology is often simpler than people realise, and with increasing pressure to reduce costs in a post-Covid-19 world, CFOs don’t have the luxury of time that was once on their side.

CFOs understandably want to avoid investing in new technology, only to revert back to old habits. This can happen when finance teams aren’t sufficiently supported following an attempted technology shift. When vendors don’t offer high-quality post-sale support, businesses feel abandoned and that it will be quicker and easier to just go back to working in Excel. They are then left with a system they’re paying for, plus a whole host of Excel models – leaving them back where they started, with a sizable dent on the balance sheet.

CFOs are responsible for controlling spiralling workforce costs – especially when it’s assumed that new recruits are needed to help with standard finance operations across the team. 72% of participants in a recent VantagePoint survey said that data finance analysts will be the most important skills to have in their team in the next year.

What isn’t always explored as an option though, is that these roles can often be covered by automation and through the implementation of suitable technology. For example, one of the projects VantagePoint is currently running is a budgeting planning consolidation system. The client is receiving all their reports automatically, without the need for someone to manually take on this role, leaving employees free to perform more strategic, value-adding planning tasks. It also means that employing a finance analyst wasn’t necessary for this company, as a far more affordable technology is providing that capability within their team.

More efficient remote working

As many of us move into a more remote model, efficient technologies also contribute towards a better work environment for your team. In a recent Generation CFO article, Viktor Stennson explains how vital softwares and tools, such as cloud solutions, are to collaboration across remote teams:

It is in times like these, when remote working has become the norm across the entire country, that you really appreciate the importance of cloud solutions, which can be accessed by multiple members of staff from anywhere in the world,” says Stensson. “Those that are going to be hit the hardest are those who are not willing to upgrade to the cloud.

If your team is still relying on manual data input methods, remote working is sure to make this more difficult, leading to more error prone data. Digitising your processes starts with knowing where and how the software-buying process starts. We know this isn’t an area many CFOs feel confident in, which is why VantagePoint guides you through the products you actually need, to prevent you from spending money on those you don’t.

Matt Benaron, Director at VantagePoint, has noticed how some of the common finance practices he sees businesses using can be damaging at the best of times – let alone when teams are working apart from one another:

Connectivity and ease of access is something that CFOs haven’t really needed to think about previously, but being able to log into one system during the monthly close, [with] everyone uploading their numbers to one system instead of taking it in turns around the office, one by one, will be transformative.

None of us knows how long remote working might have to be a part of our lives, so future-proofing your business now will pay dividends in the long run. Then, if businesses do start to move back to an office setting, they already have the tools to make working together even simpler and more efficient while enabling more meticulous work.

Get in touch to see what we can do for you

Or you can simply call us on

Clients

.png)